Welcome to the first issue of THE WIDER WORLD EXPLORER! This is the newsletter I will post weekly to keep my followers, subscribers, and interested Substackers informed of my work and the events of the wider world.

I am including weather and stock market summaries here rather than in the separate reports I have been posting. I am neither a meteorologist or a financial pro, but, I think both subjects are important to understanding the wider world of this time. So I track them. I will always provide links for individual research.

As I head into this new week, it is one of much activity and change for me and my family. My wife and I will make the long move this week to Mississippi Gulf Coast, culminating a process that has been in the works since February. We will spend a month with my sister-in-law while our new house is being finished. I don’t know how much posting I will do in that time, but I wanted to get out this first newsletter. I have spoken previously about the projects I want to achieve once I’m settled over there. There is much I want to do and I look forward to getting started.

WEATHER: In the US, wildfires broke out in Kansas on Monday 04/15, producing smoke that swirled like a Low pressure. TPW reached into the US midsection, feeding Low pressure in the west. CAPE (storm potential) was strong, leading to storms on Wednesday. Winter storms broke out in the West, Montana and Wyoming. Storms over Great Lakes area and the Midwest, produced tornadoes. Scattered rain across the South.

Ruang Volcano in Indonesia blew up in a powerful eruption prompting evacuation of an entire island.

Record rain and flooding in Dubai, UAE, admitted by authorities to have been caused by geoengineering efforts (cloud seeding).

The sun kicked up in activity with a great increase in sunspots, averaging nearly 250 on Friday. Flares shot out CMEs that sparked a G4 geomagnetic storm by Saturday 04/20. Solar action has calmed now, though the wind is still pretty high at 445 km/sec, though with a barely-there density of 0.14 protons/cm3.

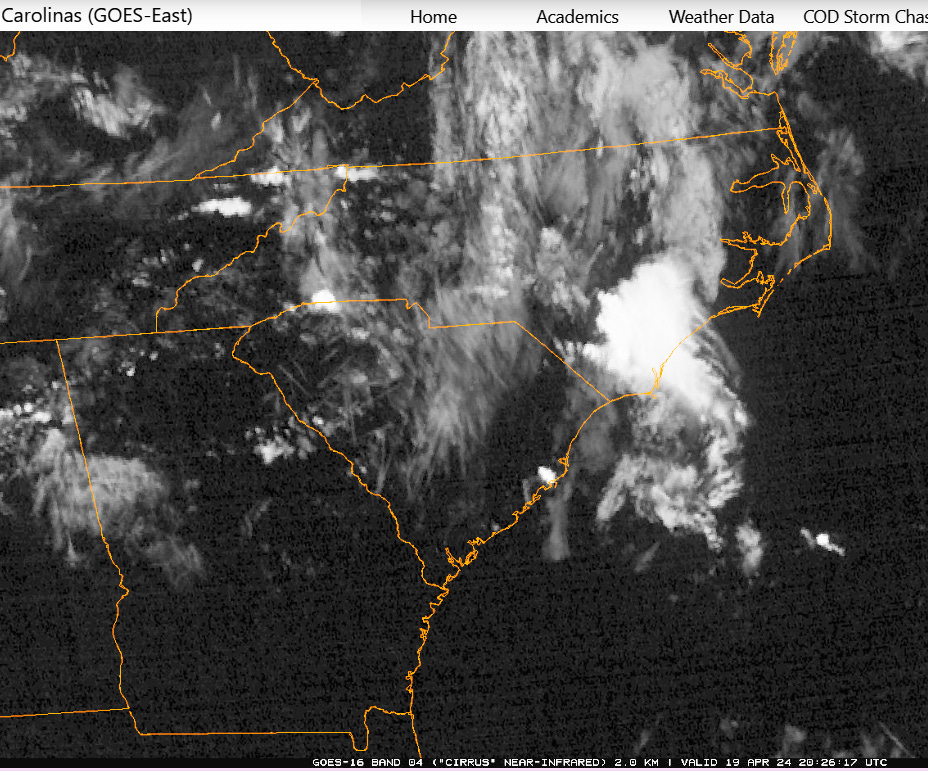

FORECAST: Anticipating rain in the Carolinas today (Sunday 04/21) and the was prepped by spraying over the last couple of days.

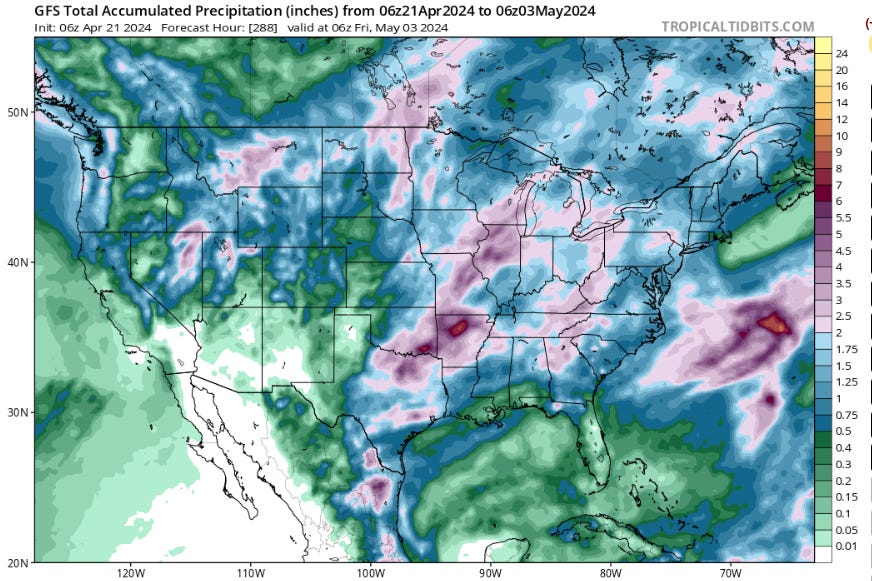

A big Low pressure system will anchor heavy rains that will cross the US from 04/25 through 04/29. Another system will follow, bringing storms to the central states and snow in the Dakotas before passing into Canada.

In temperature, mild-to-cool temps will predominate in the south until 04/27, when things will get significantly warmer with highs in the 80s F. The North will be cool-to-cold in this time with highs in the 50s F.

In this forecast period, most of the US rain will fall in the Midwest from northern Texas, through Arkansas, and into Missouri and Illinois. These areas will see some ten inches of rain. Areas in the western states in Nevada and Montana will see nearly as much.

STOCK MARKET (04/19/2024): The stock market indexes finished the week as a wash, especially the DJIA. The week began with a big drop, apparently a result of the “big show” of the Iranian “attack” on Israel over the weekend. The DJIA was pretty bumpy after that, but never reaching the high it began the week with. It finished UP by 0.02%. The S&P 500 and the NASDAQ did not so well, with both declining over the week and finishing significantly down (S&P500 -3.05% and NASDAQ -5.52%). Usually, they track much closer with the DJIA.

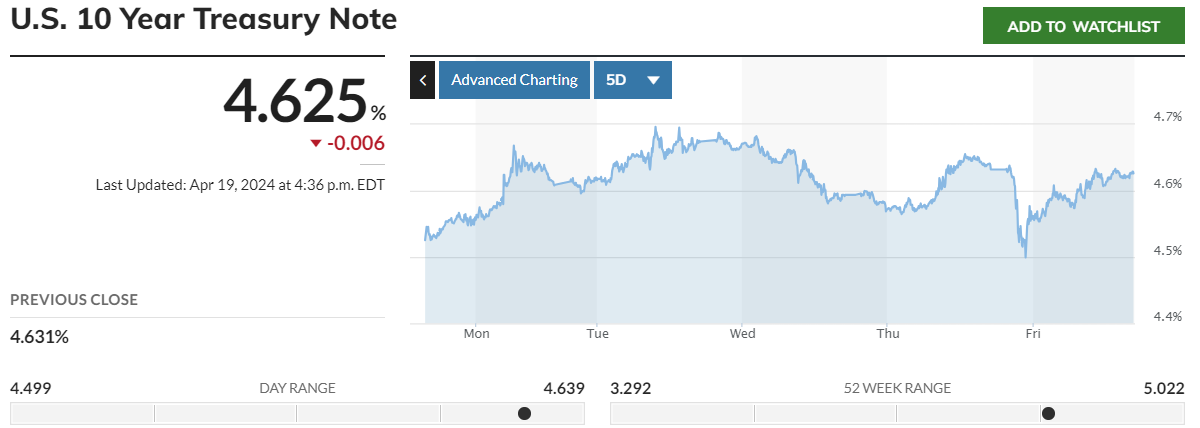

The debt market rose pretty steadily during the week, reaching highs of nearly 4.7%. This lead to fear in the market and instances of apparent debt-buying by the Federal Reserve (especially late Thursday). Even so, the US 10 YEAR NOTE finished the week at 4.625%.

The US dollar (DXY) pretty well followed the debt market all week (indicating fear trades?). The gains in gold and silver indicate possible safety seeking in the commodities.

Note that risk in the market, as measured by Greg Mannarino’s Market Risk Indicator, has been “extreme” all week. Also, the average home mortgage interest rates finished the week up across the board, with the 30 year fixed rate at 7.31%.

Investments tied to the major market indexes might have done most anything this crazy week. All considered, though, I would expect that most will finish way down.

WORLD NEWS: This was the week of Mideast war action that threatened fear, panic, and WWIII, but was played out in measured events. It went like this:

1. Iran attacked Israel (last weekend) directly (by drone) in retaliation for Israel bombing their Syrian consulate and killing some officials.

2. Contention in US Congress over an “aid” bill (weapons sales) for Ukraine, Israel, and Taiwan. Both parties want the bill but are “arguing” over what else to include in their vote (such as banning Tick Tok and giving Ukraine money stolen from the Russians).

3. Israel attacks Iran (04/19) in retaliation for Iran’s retaliatory attack on Israel.

In other matters, the US Department of Defense released an unclassified document about the Homeland Security Department’s proposed KONA BLUE project. This project was meant to investigate US Government work on recovered UFO technology. It is exotic reading in bureaucratic language. The project was never implemented.

*** Note: The Stock Market report is for information only and is not intended to be investing advice.